Aylesbury estate was selected by Tony Blair for his first speech as prime minister on 2nd June 1997, where he made his 'forgotten people' speech, saying there must be no more "no-hope areas" in new Labour's Britain.

*Blair visiting the Aylesbury in 1997 to give his first speech as prime minister*"Behind the statistics lie households where three generations have never had a job. There are estates where the biggest employer is the drugs industry, where all that is left of the high hopes of the post-war planners is derelict concrete. Behind the statistics are people who have lost hope, trapped in fatalism." (Tony Blair, inaugural speech, May 1997)

Blair vowed to 'learn from the mistakes of the past' and replace the dogma of bygone housing policies with pragmatism and common sense. The estate's regeneration was subsequently initiated as part of New Labour's 'Urban Task Force' inner-city renewal programme. The project was subsequently awarded £56m funding under the 'New Deal for Communities' partnership and regeneration plans were drawn up to transfer the estate to a housing association for redevelopment.

Failed Ballot

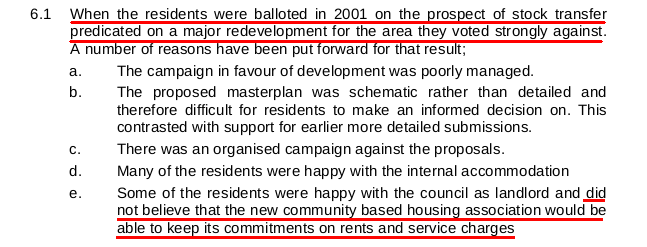

In 2001, residents on the estate were balloted on the prospect of stock transfer and redevelopment. There was a high turnout (73%) and over 70% of residents voted against the proposals. This council Executive report postulates that one of the reasons behind the 'NO' vote was that residents were concerned that they would have to pay higher rents and service charges on the redeveloped estate.

In 2002, the council's Head of Housing Regeneration said it was planning to press ahead with the redevelopment regardless, claiming that bringing the existing estate up to scratch would cost £200 million, a sum that the council simply didn't have. The Council then instructed consultants Capita to develop a 'manifesto for change' and a 'renewal strategy .. that culminated in 2005 with the council deciding on a strategy for the demolition and redevelopment of the area'.

Social or 'affordable' rent?

Residents' concerns about Housing Associations charging higher rents turned out to be well founded, when it emerged that Genesis Notting Hill (the Council's housing association partner) had delivered affordable rent instead of the social rent agreed at its Bermondsey Spa regeneration. The long list of similar tenure switches we have identified shows that this sleight-of-hand is a widespread practice tolerated by Southwark, which in any case doesn't monitor the tenure-mix of developments post completion.

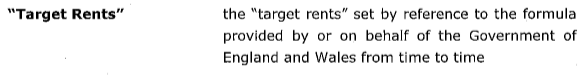

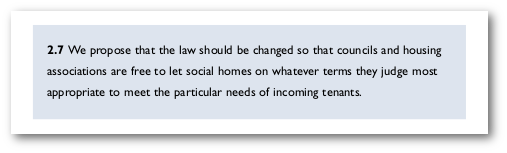

The council also insists that Notting Hill has a contractual obligation to provide social rent rather than affordable rent in the redevelopment. But its contractual agreement contains no reference to the term social rent whatsoever. Instead it refers just to 'target rent’ set by government, without any reference to the term social rent or the National Rent Regime regulatory framework which governs it. There is an obvious concern that this could be interpreted as affordable rent, as there are 'target rents' for both social rent and affordable rent set by government.

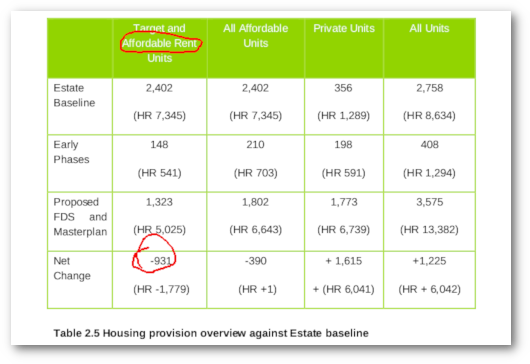

Genesis Notting Hill's planning application documents refer to the replacement social housing as 'target/affordable rent' and show that in any event there will be a net loss of 931 social rented homes across the scheme.

Extract from the planning application documents

Extract from the planning application documents

Notting Hill lobbying for higher rents

We note Notting Hill's predilection for affordable rent. Indeed, its CEO Kate Davies was a fellow of the Centre for Social Justice - the conservative think tank set up and chaired by Iain Duncan Smith, which conceived the idea of both affordable rent and right-to-buy for housing association tenants.

Genesis Notting Hill's Kate Davies (left) celebrating demolitions on the latest phase with ward Councillor Jack Buck and Cabinet member for Regeneration Johnson Situ.

Genesis Notting Hill's Kate Davies (left) celebrating demolitions on the latest phase with ward Councillor Jack Buck and Cabinet member for Regeneration Johnson Situ.

Kate Davies co-authored this report by the CSJ, in which she claimed that council estates are ‘ghettos of the poorest and neediest people’ that are ‘subsidised by the taxpayer’ and provide ‘low cost living for life funded from the public purse’. She said that tenants ‘often pay little or no rent, and get their home maintained in good order for free.’ She concluded that ‘social housing is not a desirable destination’, that ‘private ownership is preferable to state provided solutions’ and that social housing providers should be able to sent rent levels without restrictions.

Kate Davies was also a key advisor to the extremely influential Localis review (Principles for Social Housing Reform by John Hills), the insidious effects of which are well outlined on the Labour Housing Group's blog. The blog also has an article by former Notting Hill board executive Steve Hilditch, who resigned as a result of the Trust's change in direction and priorities.

In 2007, she wrote a column in The Times saying "It has become popular to criticise Hills for raising the issue of tenure reform and rent levels. But we need to get away from one type of housing-based answer for so many different types of people. Social housing should not be seen as a destination but as a springboard to a better life; a place from which people can re-establish themselves, improve their prospects and move forward". She went on to assert that "rolling assured shorthold tenancies .. give landlords greater influence to encourage positive social behaviour."

In 2008, she wrote in The Times making the case for fixed term rather than secure tenancies - "We need a greater diversity of options in the social sector. For example, some accommodation rented at almost market price.. As well as tenure reform, I would like to see greater flexibility in the housing available and who it is offered to."

In 2008 she also wrote for the Guardian in defence of Boris Johnson's introduction of affordable rent and wrote an article on the Conservative Home website arguing that Councils should promote more homeownership.

The Guardian notes that Davies's partner, Nick Johnson, is chief executive of H&F Homes, the "arms-length management organisation" that manages the Council's homes and of the council's tenants and leaseholders.

Kate Davies was recently criticised by local councillors for Notting Hill's rent hikes and evictions on the St James estate in Bermondsey. Cllr Pollak described Notting Hill as a 'predatory, rogue landlord'. Kate has clearly come a long way since her days as Kate née Marshall, when she was Secretary General of the Revolutionary Communist Party..

Kate left the RCP when she married disgraced Bexley council leader Nick Johnson, who after filing for early retirement (and bumper pension) from Bexley on grounds of ill-health, went on to set up 'Davies Johnson Ltd' - a consultancy employed by Hammersmith & Fulham Council to advise on the redevelopment of council estates in its Earls Court redevelopment.

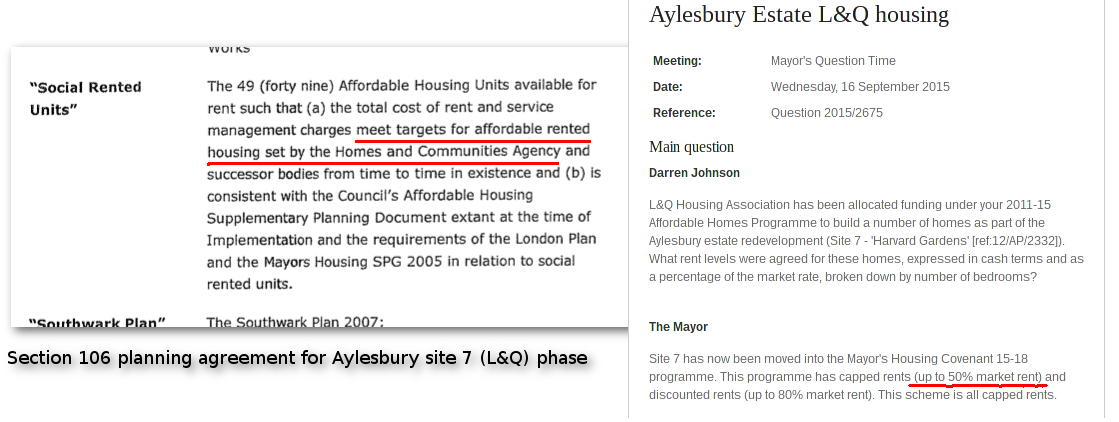

Harvard Gardens

The most recent phase of the scheme (site 7 - Wolverton/'Harvard Gardens') is being developed by L&Q and comprises 147 new homes, of which 48 will supposedly be for 'social rent'. However, the section 106 planning agreement for the site says 'affordable rent' and a question put to the Mayor confirms that these will be let at affordable rent of up to 50% market rent.

Refurb vs Demolition

At the 2015 CPO Public Inquiry, Professor Jane Rendell from the Bartlett School of Architecture questioned the council's cost/benefit appraisal for its decision to redevelop rather than refurbish. She took the Inquiry through all of the figures and showed that cost estimates for refurbishment had been inflated by nearly £150m. (See AJ article).

Objectors gave evidence showing that later phases of the estate had been allocated funds under the council's WDS programme (Decent Homes Standard works programme). They showed the Inquiry section 20 invoices that they had been sent by the council, detailing the estimated cost of the Decent Homes Standard major works charges, i.e. bringing the homes up to modern standards. These showed that homes on the estate were being brought up to Decent Homes Standard at an average cost of just £20,261 per home[^1].

The cost so far

The first public funding spent on the scheme was the £56m from the government’s NDC (New Deal for Communities) programme.

The scheme was subsequently allocated 46m from the government’s Estate Regeneration Fund and £27m from GLA funding to date (see source here), plus £13m of HCA funding, which helped build the completed phase 1a of the scheme (see source on page 20 of the this document).

In addition, the Council has spent a considerable amount of its own HRA account funds on the scheme. At April 2015, the Council had already spent £46.8m on the scheme (see paras 6-7 of this response to an FOI request).

This Cabinet report confirms that the Council subsequently expected to spend £52m between 2015 and 2020.

Then in July 2020, the Council committed a further £193m just in order to complete the first phase of the scheme alone.

This amounts to a total £433.8m of public funds just in order to complete the first of four phases of the estate's redevelopment.

In 2016, the Council agreed to fund £22m of works that NHHT was originally required to fund under the original DPA agreement.

In 2018, it was revealed that the Council could end up losing vast amounts of public money on the scheme while Notting Hill is guaranteed a 21% protected profit.

According to Notting Hill's viability assessment its 21% profit extracted from the redevelopment is currently estimated to amount to £163m[^7].

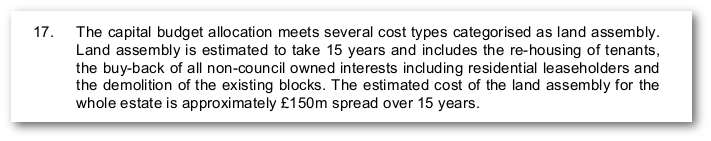

When the Council Executive took its decision to redevelop the estate in September 2005, it did so on the basis of a costings estimate which calculated that the scheme would be cost broadly cost neutral to the Council. Later estimates in 2014 showed that the Council's estimated costs had ballooned to £150m[^4], but this figure has been well exceeded and the first development site is not even completed yet.

Six Acres estate

Other London boroughs take a different approach to regeneration. Islington has an estate called the Six Acres estate near Finsbury Park. The Six Acres estate was built at the same time as Heygate & Aylesury, by the same contractors (Laing) using the same system (Jespersen 12M).

Instead of demolishing its estate and handing it over to the private sector at a loss, Islington Council chose to refurbish the Six Acres estate in 2012. The 473 homes on the estate were refurbished with new external wall insulation, new entry doors, exterior furnishing improvements, green roofs and cycle shelters.

Extensive research by the University College London and case studies by leading architects has shown that refurbishment is better not just financially, but also socially and environmentally.

More information about the Six Acres estate regeneration can be found here, here, here, here and under planning application ref: P072153 on Islington Council's Planning Portal.

Photos of Six Acres before regeneration

Photos of Six Acres before regeneration

Photos of Six Acres after regeneration

Photos of Six Acres after regeneration

The London Borough of Wandsworth also has an estate made with the same construction system as the Aylesbury estate - the Doddington & Rollo estate in Battersea. Wandsworth has no plans to demolish the estate.

Doddington & Rollo estate in Battersea

Doddington & Rollo estate in Battersea

Design Criticisms

Clearly there is a strong business case for refurbishment over demolition. However, Southwark says it's not about the fabric of the estate but its design. In her Public Inquiry evidence, Southwark's in-house architect confirmed that "the condition of the buildings does not, itself present a case for demolition and redevelopment" but that the "fundamental issue is the estate layout and the poor urban environment this presents". In paragraph 5.3 of her evidence she gives examples of this 'poor urban environment' which include criticisms that:

"The scale and orthogonal formation of the blocks (some of the longest in Europe) does not correspond to human scale, nor does it create opportunities for neighbourliness and local neighbourhood identity."

"The estate roads, which serve to access gargages, typically terminate in dead ends, and have little relationship to front doors of dwellings". This means that "residents are deprived of a clear address, and identity, and experience various practical inconvenincies i.e. deliveries finding it difficult to locate front doors."

"Lack of ownership" of the estates green spaces, means that "they are under used".

Council leader Peter John is one of the driving forces behind the Aylesbury estate scheme supported by a cross-party 'sink estate' rhetoric. He wrote an article in support of David Cameron's estate demolition proposals in Jan 2016, arguing only that Cameron's plans weren't ambitious enough and that more government funding should be allocated to the programme. In the article he describes the Heygate & Aylesbury estates as "symbols of inner-city neglect, with crime, antisocial behaviour, health inequalities and unemployment the only things that flourished there". He added that "both had become hard to let to council tenants, and reinforced poverty, crime and inequality" and concluded that redevelopment was the only way to ensure "genuinely mixed communities".

In a local news interview he claimed that "brutalist architecture wasn’t conducive to building a successful economic community". He evidenced this claim with an anecdote, in which he described local MP Harriet Harman's visit to the Aylesbury estate: "Harriet and a councillor were in a lift with a man injecting drugs in his penis. That’s not the sign of a successful community".

The Council's Statement of Reasons justifying the Compulsory Purchase Order, claimed that the Council's strategy is to "rebalance the tenures within the estate to create a more mixed community" (para 1.4).

One fact that escapes Councillor John's brutalist sink estate rhetoric is that the Aylesbury estate is not exclusively concrete construction; there are over 300 traditional brick built properties on the estate equally earmarked for demolition.

One block of over 300 red brick properties on the Aylesbury estate

One block of over 300 red brick properties on the Aylesbury estate

Community facilities

The Council has argued that the regeneration is providing public benefits including a new library, a new GP clinic, and new nursery facilities. But what is not publicised is that Notting Hill is only contributing £9m towards the £38m cost to the Council of delivering these facilities.

Aylesbury Medical Centre, East St Library, Wells Way Library, Aylesbury Learning Centre

Aylesbury Medical Centre, East St Library, Wells Way Library, Aylesbury Learning Centre

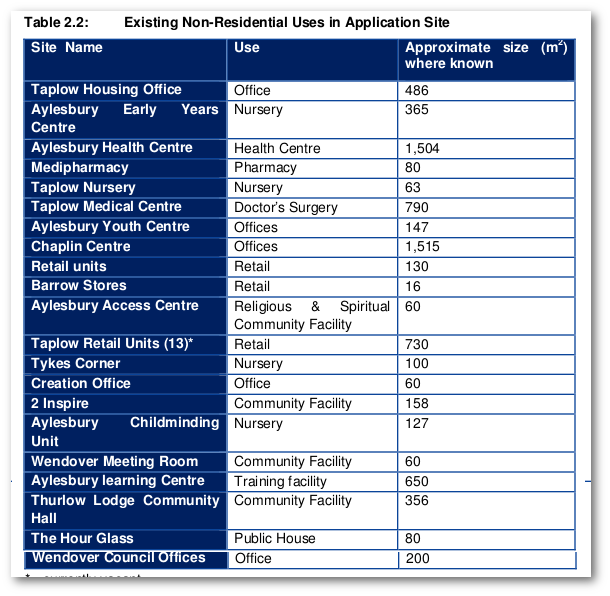

Neither is it being publicised that a vast array of community facilities on the existing estate are not being replaced.

List of community facilities being lost

List of community facilities being lost

In addition, there are four multi-utility games courts on the estate which are due to be built on and not replaced.

Environment/Sustainability

Generous existing green open space that will not be replaced

Generous existing green open space that will not be replaced

Despite the fact that the redeveloped estate will be a stone's throw from the new Bakerloo line station on the Old Kent Road, the Aylesbury estate masterplan outline planning application gave consent for a total of 1,378 parking spaces in the new development, equating to four out of ten new households with parking.[^3]

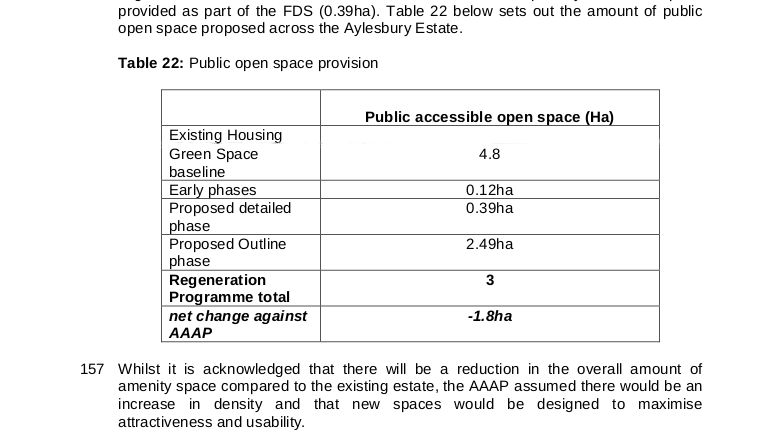

The planning committee report for the Aylesbury masterplan application also confirms that there will be a net loss of 1.8 hectares of open space as a result of the redevelopment:

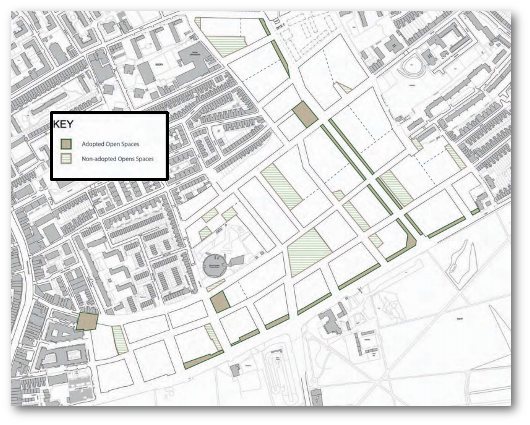

Further, the new open spaces in the development will not be public open spaces adopted by the council; they will be privately owned and managed by a subsidiary of Notting Hill Housing Group.

Extract from planning application docs

Extract from planning application docs

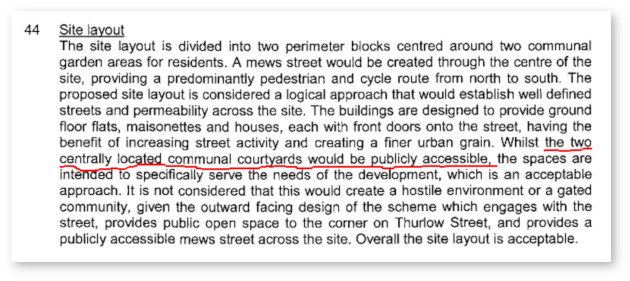

The previous phase of the scheme (Harvard Gardens) which was redeveloped by housing association L&Q, was supposed to give public access to play areas in its two central courtyard areas. This was acknowledged in the planning committee report for this phase:

Extract from planning committee report for Harvard Gardens

Extract from planning committee report for Harvard Gardens

However, these have since been gated off and public access curtailed by introducing key fob locks such that the courtyards can only be used by residents in the blocks.

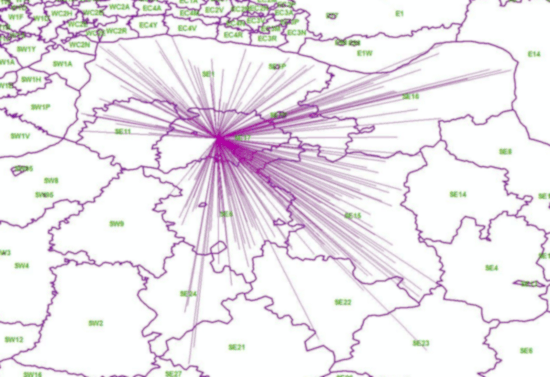

Aylesbury diaspora

Loretta Lees, a leading professor of Human Geography has published a study researching the displacement of Aylesbury estate tenants as a result of the regeneration.

She also gave evidence to the Aylesbury CPO public inquiry showing how leaseholders were also being displaced, not just from the area but to outer boroughs and beyond as a result of the low compensation payments they receive. Her evidence shows that only 10% of tenants decanted to date have been rehoused in new homes on the redeveloped estate and that of the circa 250 leaseholders decanted to date, only 7 have taken up shared ownership in new homes provided by the scheme.

In Sep 2016, the Secretary of State announced that he would be blocking Southwark's application for a Compulsory Purchase Order, on the grounds that the scheme is in breach of basic human and equalities rights. The Secretary of State's decision was based on the fact that many elderly residents and those from black and ethnic minority groups were being forced to relocate elsewhere, rather than being rehoused on the scheme footprint. Southwark subsequently appealed the ruling and successfully managed to convince the High Court to have the decision overturned.

Eviction Threat OAPs - Southwark News article

Eviction Threat OAPs - Southwark News article

Misc links

Video footage of the 2015 Aylesbur y estate CPO public inquiry. 2005 Frost Associates report. April 2005 BPTW report. (Redacted) Development Partnership Agreement(DPA). (Redacted) DPA Appendices. (Redacted) DPA Appendix 7 - Business Plan. Audit showing community spaces lost Albany Place - DHN info

2015 CPO proofs of evidence

Jackie Fearon - Aylesbury Area Manager, Southwark Council

Elaine Taylor - Senior Regeneration & Development Manager, L&Q Housing

Mark Maginn - Sales & Acquisitions Manager, Southwark Council

Tim Cutts - Planning Policy Team Leader, Southwark Council

Jane Seymour - Development Partnership Broker, Southwark Council

Press articles

https://widerimage.reuters.com/story/residents-resist-demolition

https://www.theguardian.com/society/2016/jul/13/aylesbury-estate-south-london-social-housing

Footnotes:

[^1]: Pg 2 of the section 20 invoice shows that 611 homes are being brought up to Decent Homes Standard at a total cost of £12,380,030 - (average = £20,261).

[^2]: Aylesbury homes demolished to date: 1-41 Bradenham & 1-12 Red Lion Close (site 1a), 1-59 Wolverton (site 7) - [Total = 112].

[^3]: See paragraph 2.5.1 of the masterplan application's Transport Statement

[^4]: See paragraph 17 of this council report

[^5]: See paragraphs 26 and 27 of this Executive report which say that a fixed land receipt has been agreed for the First Development Site (£17.5) but that land receipts for remaining phases will be calculated on a residual basis.

[^6]: Paragraph 39 of the closed version of this April 2014 Chief Executive report "39. At sales values over £471 per ft² the Council will receive 50% of the profit."

[^7]: Paragraph 19 of the closed version of the above closed report says "Barratt will agree to pay NHHT at practical completion half of the private sale Gross Development Value (based on £451 per sqft) less 21% which they retain in profit."