New viability assessment shows £13.5m profit

Notting Hill Genesis (NHG) stands to make a £13.5m profit from its second attempt at getting planning permission for the next phase (2B) of the Aylesbury regeneration. This is according to a new viability assessment submitted by NHG in support of their updated planning application. NHG's first attempt was approved by Southwark's planning committee in January 2024, but made no further progress, after getting entangled in a successful High Court challenge by Aylesbury resident and campaigner Aysen Dennis.

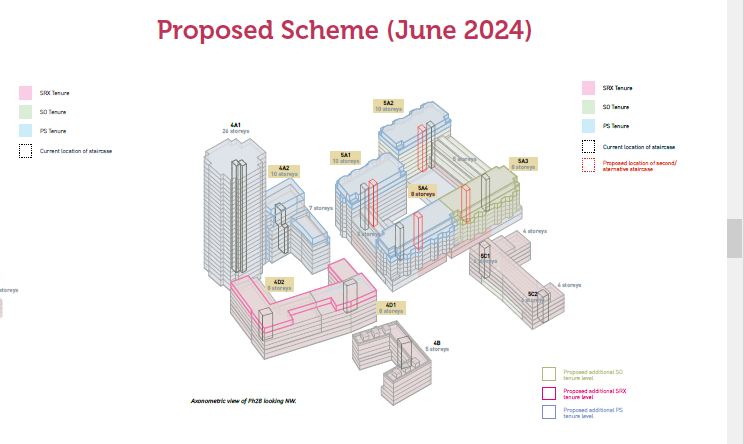

NHG's updated application takes account of new requirements for a second staircase in tall buildings and other safety measures. Extra floors have been added to compensate for lost residential floorspace in seven of the eleven buildings, which will be between five and ten storeys, with one tower of 26 storeys. The number of homes will increase from 614 to 640, with an increase in the number of social rented homes (from 163 to 173) and of intermediate part-buy/part-let homes (from 82 to 89). The number of private homes has been increased to 378 from 369 [^1]

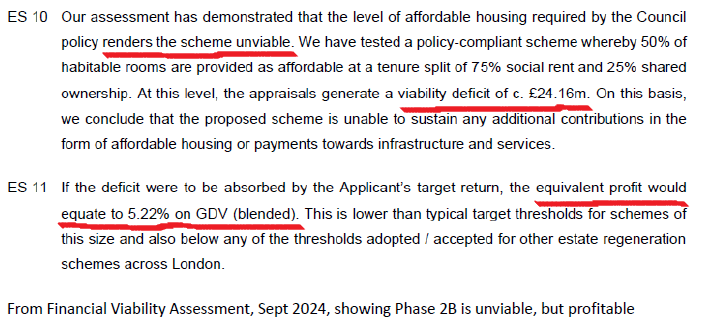

£0 for the land, but still not financially viable

While the updated Phase 2B should make NHG at least £13.5m profit, NHG says that it is still not viable, despite gaining revenue from the extra floors. The updated viability assessment for the scheme concludes 'the appraisals generate a viability deficit of c. £24.16m'. It goes on to say that 'if the deficit were to be absorbed by the Applicant's [NHG] target return, the equivalent profit would equate to 5.22% on GDV (blended)'. This 'Gross Development Value' is the combined worth of all the housing and commercial premises and amounts to £258.71m. So, even though the scheme is 'unviable', it is still expected to make a profit of around £13.5m (5.22% of £258.76m) [^2].

According to this line of thinking, while there is the £13.5m profit, this is still a 'viability deficit'. NHG says of the profit that 'This is lower than typical target [profit] thresholds for schemes of this size and also below any of the thresholds adopted/ accepted for other estate regeneration schemes across London' [^3].

The assessment makes the cautious caveat that should both sales values and costs improve by around 5%, then the scheme would become viable, which means it could generate a much higher profit of 14.55% of GDV and still provide the 50% affordable housing, as required by the Southwark Plan 2022.

The viability assessment also excludes inflation and sets the benchmark land value at £0, 'based on the development agreement between NHG and LB Southwark', which indicates that nothing will be paid for the land. If NHG had to pay for the land then this would increase the 'viability deficit' and reduce profit [^4].

The Mayor gives £13.72m more in funding for just 17 additional homes

The updated assessment also shows that the Mayor is giving NHG an extra £13.72m in affordable housing grant, raising it to £42.51m from £28.79m. The number of affordable units is also rising, but only by 17 units, which means a nominal grant for each additional unit of £807,358 [^5].

Put another way, the average grant for each unit of affordable housing has risen from £117.49k per home to £162.25k per home, which is about a third of the total build cost for an affordable home [^6].

The Mayor repairs NHG's bottom line?

The extra affordable housing grant also makes for a healthier looking bottom line. While the updated assessment shows a 5.22% profit on GDV, and is a fall from the original assessment of a 12.27% profit (also said to be unviable by NHG), the fall would be worse without the Mayor's contribution [^7].

In cash terms, the fall in the profit rate for the updated scheme has increased the 'viability deficit' from around £6.69m to around £24.16m. The increased Mayor's grant saves a further £13.72m from being added to this deficit [^8].

What we say - what's the grant being spent on?

It is important to remember that a viability deficit is not the same as a loss. A viability deficit is simply the difference between the profit a developer wants to make and what the viability assessment estimates they will make.

NHG want to make 14.55% profit on the total scheme value, which equates to around £37.65m on this phase, but say they are only going to make 5.22% (around £13.5m) leaving them with a 'viability deficit' of around £24.16m. This is still a profit though (of £13.5m) and it acknowledges that small increases in sales values could significantly improve this.

NHG are also benefitting from an increase to their affordable housing grant, which has risen by £13.72m, but with only a small increase in affordable housing, of seventeen 17 units (10 social rent, 7 shared ownership). NHG are also getting the land for free.

This does not look like a bad deal for NHG.

A question also naturally arises as to what exactly the Mayor's affordable housing grant is being spent on, when the rate of grant per unit rises so steeply (by nearly 40%), while a comparison of the original and updated viability assessments show that total development costs for the scheme have risen by much less (16%). It's hard not to suspect that the increase has much to do with maintaining 'viability' as it does with securing more affordable housing [^9].

Footnotes:

[^1]: Planning Statement Addendum, Oct 2024, 22/AP/2226 - find via https://planning.southwark.gov.uk/online-applications/applicationDetails.do?activeTab=documents&keyVal=RDU2YJKB00300; Public consultation June 2024, exhibition board 9 http://www.aylesburynow.london/web/uploads/files/news_254_0.pdf?nocache=4626

[^2]: Despite this NHG say that the extra floors are 'to ensure the scheme viably delivers the required affordable homes' - Planning Statement Addendum, Sept 2024, 3.9, 22/AP/2226 - find via https://planning.southwark.gov.uk/online-applications/applicationDetails.do?activeTab=documents&keyVal=RDU2YJKB003003.9

[^3]: Financial Viability Assessment, Phase 2B, Aylesbury Estate Regeneration, ES10, ES11, Sept 2024. This can be found via the Southwark Planning Register, using ref 22/AP/2226, under the 'Documents' tab. See also the Appraisal Summary, pg 136, 137, 138. A £37.66m profit on the private and affordable housing, plus commercial profit, is listed as 'Additional Costs', generating a loss of £24.165m; taking out the £37.66m from the cost column turns this into a £13.495m profit.

[^4]: Financial Viability Assessment, Phase 2B, Aylesbury Estate Regeneration, ES12, Table 1.1, ES13, Sept 2024. This can be found via the Southwark Planning Register, using ref 22/AP/2226, under the 'Documents' tab.

[^5]: Figures for GLA grant and affordable housing taken from Financial Viability Assessments of May 2022 and Sept 2024.

[^6]: The grant for the original proposal was £28.79m for 245 affordable homes - an average cost of £117.49k per home. The grant for the updated proposal is £42.51m for 262 affordable homes - an average cost of £162.25k per home. By calculation, using averages, the Mayor's grant is worth about a third of the cost of the affordable housing - £325,280,540 (total cost) divided by 640= £508.25k av cost per unit; x 262 affordable units = £133.162m; divided by £42.51m = 3.13. See the Appraisal Summary, Financial Viability Assessment, Sept 2024, pg 137 for total cost figure.

[^7]: For the 12.27% GDV profit see the Financial Viability Assessment, Phase 2B, Aylesbury Estate Regeneration, ES 9, May 2022. This can be found via the Southwark Planning Register, using ref 22/AP/2226, and then under the 'Documents' tab. By calculation, the original profit is 12.27% x £244.44m GDV = £29.98m; the updated profit is 5.22% x £258.76m GDV = £13.5m. See also the Appraisal Summary, pg. 143, 144.

[^8]: For the £6.69m viability deficit see the Financial Viability Assessment, Phase 2B, Aylesbury Estate Regeneration, ES 8, May 2022.

[^9]: Total costs have risen from £279,815,369 to £325,280,540, between May 2022 and Sept 2024 - a difference of £45,465,171, a 16.29% rise. Figures for Total Costs from Appraisal Summaries, Financial Viability Assessments, May 2022 and Sept 2024.