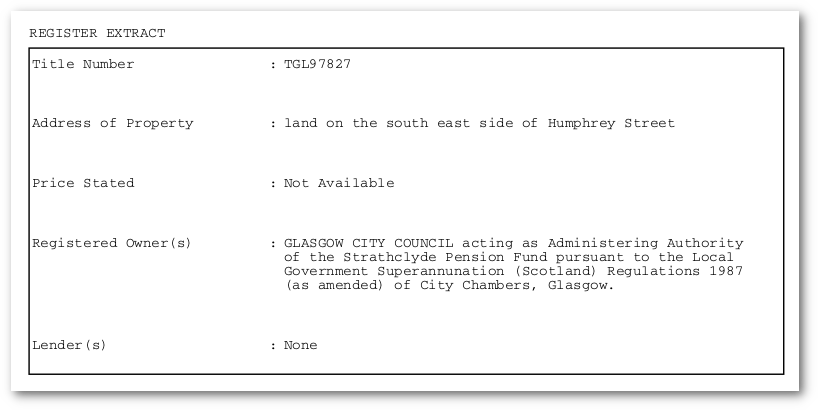

A proposal for the development of Southernwood Retail Park is due to be decided at Southwark's planning committee this Tuesday evening. Developer Glasgow City Council, acting as trustees for its (Strathclyde) Pension Fund, wants permission for a mixed-use development of 725 residential units, with a hotel, cinema, shops, restaurants and offices. The proposed scheme has seven blocks, including a 48-storey tower. The site is currently occupied by Argos and Sports Direct, just opposite Tesco and over the road from Burgess Park.

Southernwood offers, in round figures, 35% affordable housing; 25% of the total housing will be social rent, 10% intermediate, in line with the emerging New Southwark Plan's minimum requirements, giving 219 units.

Viability conundrum

Viability assessments have become notorious as a way for developers to avoid their affordable housing obligations. Over the past few years housing campaigners and several high profile cases have managed to shed some light on this practice, leading to changes in policy and greater scrutiny of developer's viability claims.

In Southwark this had meant we are starting to get the 35% affordable housing that we have been denied until now. But while developers are offering 35% affordable housing, they continue to insist that their schemes are unviable. Southernwood Retail Park is a case in point. Here the developer (Glasgow City Council) claims that they will only make 2.24% (£8.4m) profit on Gross Development Value (GDV); Southwark's consultants beg to differ and say 16.37% (£62.5m) can be made. Both figures fall short of Glasgow CC's profit target (set by themselves) of 18.84% (£72m), so the development is technically deemed 'unviable'.

Glasgow CC's 18.84% target profit exceeds its benchmark return of 10.4% set by its pension fund manager for real estate projects (DTZ), who manage Southernwood on its behalf (See DTZ, pg 97 in Strathclyde Pension Fund's most recent annual report).

Despite the Southernwood scheme being deemed 'unviable', Glasgow CC says that it will deliver 35% affordable housing, comprising 25% social rent and 10% intermediate, in line with minimum local policy requirements. The Council's planning report accepts the 35% affordable offer, but without addressing the difference in the profit estimates or considering the difference in the profit target and the pension fund's DTZ target benchmark.

After so many major developments at the Elephant & Castle and elsewhere in Southwark have been allowed to flout affordable housing requirements, this can be counted as progress, but leaves the true viability of the Southernwood scheme unresolved. This is important, because as well as all the minimum affordable housing requirements, there is also a general requirement to produce the maximum reasonable amount of affordable housing, which obviously cannot be known, unless the real viability position is known. There is also the danger that the development proves to be 'undeliverable' and the developer returns to get the promised affordable housing reduced.

The Southernwood scheme joins Ruby Triangle and Cantium Retail Park as an 'unviable' scheme that will deliver 35% affordable housing. Unlike Ruby Triangle, but like Cantium Retail Park, no 'late stage review' of viability is proposed for Southernwood. This is a comprehensive viability review where developers are required to disclose in detail actual costs and revenue received, to establish the scheme's real profitability and enable the local authority to 'claw back' additional affordable housing, should the profit be greater than anticipated. Given the site's position alongside the likely site of a new tube station should the Bakerloo line extension be built, this looks like a serious omission.

Affordable housing - 35%, 40% or 50%?

Two other features in the Southernwood application stand out - the first is that the applicant, Glasgow City Council, is reluctant to take advantage of any public funding, such as that available from the Mayor of London, which could raise the affordable housing to at least 40%, giving another 30 or so affordable homes. All schemes are expected to consider this, to maximise affordable housing, under the Mayor's Housing policy. Glasgow CC's surprising explanation for not applying for public funding is that it claims it will make the scheme less viable. As related in the planning committee report (Para 182,183), this is because the £28,000 per unit grant (for each of the 250 affordable homes) would not make up the full loss in value of converting 5% of the private market homes into affordable homes. It appears, however, that in reaching this conclusion Glasgow CC have used the highest values of the private flats in the 48-storey tower for comparison, rather than the lower-value private flats in the lower blocks, the difference being £600k per unit versus £500k per unit.

Glasgow CC also say that they will not be in time for the current funding round, which requires a start on site before 31st March 2021, notwithstanding that Phase 1 of the scheme would commence in 2021, to be "open and operational by 2022/23" (Para 44); the report simply proposes a condition that this is reconsidered before the scheme is implemented. The second half of the scheme won't commence until May 2030 and won't complete until 2033 (See para 57 of planning committee report).

The second feature is that the site is both owned by a local authority and is in an area marked as a Strategic Industrial Location and on both counts should deliver 50% affordable housing, according to the draft New London Plan, which would raise the number of affordable homes to around 360.

Glasgow CC submitted its own legal opinion on this, arguing that the site should not be considered as public land because it would " penalise the members of the [Pension] Fund simply for having worked as public servants" (see para 173 of planning committee report). There can be no dispute that the land is owned by Glasgow City Council, on behalf of its pension fund, as land Registry deeds show; nonetheless Southwark and the Greater London Authority (GLA) have accepted Glasgow CC's argument.

Southwark's and the Mayor's decision flies in the face of the Mayor's planning policy, which has its own specific Guidance Note for determining what constitutes public land - Threshold Approach to Affordable Housing on Public Land (July 2018). This defines it as "Land that is owned or in use by a public sector organisation, or company or organisation in public ownership" (para 9). Anticipating disputes on the definition, the note goes on to say that these "will be determined with reference to the Public Sector Classifications Guide (PSCG) published by the Office for National Statistics" and this guide lists Local Government Pension Funds as a public sector body, just as Glasgow CC is a public sector body.

Notwithstanding this Southwark argues in the legal advice appended to the planning committee report that imposing the higher 50% affordable housing "would reduce the capital value of the site and therefore the Fund’s ability to pay pensions to retired workers" and that "It would be unfair on the retired workers if their pension expectation might possibly be impacted.."

It might well be 'unfair' to pensioners if this happened, but it would also be 'unfair' to those who need affordable housing if it is not delivered when required by policy. It is also unfair on planning committee members who are recommended to approve this scheme without the detailed policy requirements or the alleged 'impact' on pensions having been properly explained in the planning report.

As unedifying as it would be to see two local authorities fight over their respective shares of a development's profit, one on behalf of pensioners, the other, on behalf of those who need affordable housing, Southwark and the GLA's responsibility in this situation is to vigorously represent the interests of those in housing need and it has not done so, by giving way so easily.

TfL gives scheme (many) red lights

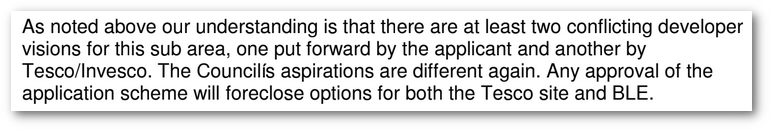

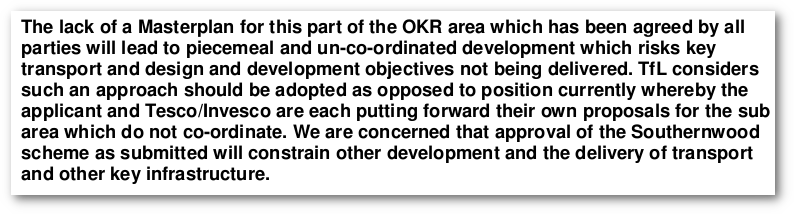

There also appears to be major issues, to say the least, with Transport for London (TfL), particularly around the impact of the development on plans for the proposed Bakerloo Line Extension (BLE). In its latest communication of barely a month ago, in which TfL urges Southwark not to approve the application, except for "the rear portion of the site", until the Bakerloo Line Extension (BLE) is complete, for fear that it will be compromised.

Extract from TFL's Objection to the scheme

Extract from TFL's Objection to the scheme

Extract from TFL's Objection to the scheme

Extract from TFL's Objection to the scheme

TfL make the damning accusation that Southwark has 'no joined-up thinking', which must sting after several years of consultation and planning for the yet-to-be adopted Old Kent Rd Area Action Plan (AAP) and Opportunity Area.

TfL examine eight aspects of the scheme for policy compliance - Strategic approach, Healthy Streets, Transport Capacity, Transport Assessment, Cycling, Car Parking, Deliveries, Funding - and gives the red light to six (meaning 'Major changes/redesign required'), with amber for two, including 'Funding' ('Further work required')'. One of the more radical amendments TfL require for policy compliance is to move the proposed hotel, currently to face onto the Old Kent Rd, but overall TfL consider that it is 'unlikely that the significant design changes and stringent management measures necessary to make the existing proposals workable can be made to address the issues' raised.

The planning committee report addresses TfL's objections at length, over 14 pages (Para 524 - 602). While it acknowledges the critical importance of the BLE to the success of the whole Opportunity Area, much of the remedy the report proposes depend on future agreements between all parties, including rival developers Tesco/Invesco, to be secured by s106 and other legal conditions after consent is granted, when the common-sense response is surely to resolve these problems before consent is given.

Conclusion

Southernwood provides the peculiar spectacle of one public authority building homes on land owned by another, but refusing to apply for public funding, because that would make an 'unviable' development more unviable, added to which it is promising to provide affordable housing the figures say the scheme cannot provide.

As noted above, Ruby Triangle and Cantium Retail Park were also both declared technically non-viable and depend upon the rise in land values that the Bakerloo Extension will bring, so should the problems feared by TfL occur, they may well have consequences for their promises of affordable housing too.

The TfL objections to Southernwood also adds weight to the argument that the whole Opportunity Area project is developer-driven, rather than plan-led and that the approval of major developments, such as Southernwood in advance of the adoption of the Area Action Plan is premature and rendering it redundant. Southwark should not be granting permission for a scheme in such a key location beforehand, especially when it is not due complete until 2033 and no late stage viability review is proposed.